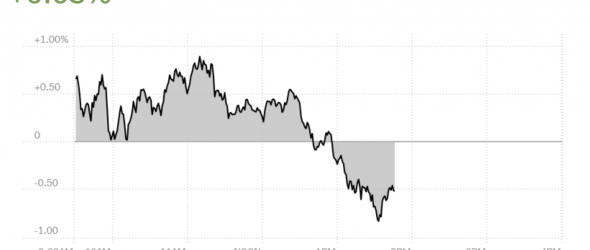

Stocks on Wall Street fell Tuesday for a third-straight session, led by another sharp sell-off in shares of the same giant tech companies that had led the market back into record territory last month.

The Nasdaq composite tumbled more than 4 percent, in the latest of a series of declines for technology stocks that began last week as investors abruptly began to recalibrate their appetite for the previously high-flying shares. The S&P 500 fell about 2.8 percent.

The trigger for the sell-off remains at issue. Late last week the Financial Times reported that SoftBank, a Japanese conglomerate that has a history of making outsize bets, had been a large buyer of options linked to the rising tech stocks, helping supercharge both the tech sector, and the broader stock market, in August. SoftBank declined to comment to The New York Times.

But the idea that a single large buyer could have accounted for the recent momentum of giant tech stocks — Apple alone was up more than 20 percent last month — fed the worry among some investors and analysts that the tech rally had gone too far too fast.

“We’ve seen these incredible run-ups,” said JJ Kinahan, chief market strategist at TD Ameritrade. “People are starting to question their valuation.”

On Tuesday, Apple fell more than 6 percent, and Microsoft dropped more than 5 percent. Amazon, Facebook and Google’s parent, Alphabet, were also sharply lower.

Those companies have become crucial bellwethers of the broader market this year. Since the coronavirus crisis hit in March, investors had flocked to buy their shares, convinced that their already dominant positions in the American economy would only grow stronger as lockdowns resulted in more work from home and less spending elsewhere.

As their market values surged, so did their influence over benchmarks like the S&P 500. At the end of last week, these five stocks accounted for some 24 percent of the index, according to Goldman Sachs analysts.

With Tuesday’s decline, the Nasdaq breached what market watchers call a correction — a decline of more than 10 percent from its last high. That’s an arbitrary threshold but is often taken as a signal that investors have turned more pessimistic about the markets. The S&P 500 is down about 7 percent from its highest point, reached on Wednesday.

Oil futures also fell sharply on Tuesday, reflecting concerns about supply of crude as the summer driving season in the United States ends and with the Organization of Petroleum Exporting Countries, which slashed oil production in May, now adding to output.

Shares of energy companies followed the price of crude lower, with Halliburton, Marathon Oil, and Diamondback Energy among the worst performers on the S&P 500.

—

Lululemon reports a quarterly profit as consumers flock to yoga pants.

Lululemon, the athletic apparel retailer known for its $100 yoga pants, managed to eke out an increase in sales during a grim environment for clothing companies.

The retailer said on Tuesday that net revenue in the three months that ended Aug. 2 rose 2 percent to $903 million, from the same period the year before, even as sales at company-operated stores plummeted by about 51 percent. Direct-to-consumer revenue more than doubled in the second quarter, helping Lululemon post a net profit of about $87 million. Net revenue had declined 17 percent in the first quarter, as the company grappled with temporary store closures.

Lululemon, with its upscale customer base and comfortable clothing, has been viewed as a relative winner as the pandemic has roiled the retail industry and especially apparel chains. Purveyors of clothing meant for offices and formal settings have struggled in recent months, with major names like Brooks Brothers and J. Crew filing for bankruptcy. But consumers have flocked to athletic clothing and so-called athleisure garb.

Earlier this summer, Lululemon announced its acquisition of Mirror, a home fitness start-up that sells a $1,495 wall-mounted machine for streaming workout classes, signaling an expansion beyond apparel.

—

JPMorgan says some of its workers and customers misused pandemic aid.

Some JPMorgan Chase employees and customers misused federal coronavirus aid money, according to an internal memo reviewed by The New York Times.

The memo, which was sent by the bank’s operating committee on Tuesday, said that officials had found “instances of customers misusing Paycheck Protection Program loans, unemployment benefits and other government programs.”

The committee, a group of senior leaders that includes its chief executive, Jamie Dimon, as well as its chief risk officer and its general counsel, did not describe any specific misconduct by employees, but it said that, in general, some of the activities officials had identified could be illegal.

“We are doing all we can to identify those instances, and cooperate with law enforcement where appropriate,” they wrote.

Banks played a central role in distributing much of the $2.2 trillion in aid created by the federal government under the CARES Act to help Americans deal with the economic effects of the coronavirus. They were in charge of vetting businesses seeking aid money, and they also had a hand in distributing unemployment benefits that included an extra $600 a week in federal funds.

There was never a hope of keeping fraudsters away from the money entirely, and many lenders are scrutinizing customers’ activities. Some determined criminals created fake businesses to take advantage of the forgivable loans offered by the Paycheck Protection Program, while others got funds using stolen identities. JPMorgan, the country’s largest bank, handed out more than $29 billion in P.P.P. loans, the most by any lender.

It is not clear how widespread the misconduct among JPMorgan’s employees and customers had been or how it compared with other banks.

“We distributed the note to reiterate our high standards,” said a JPMorgan spokeswoman, Patricia Wexler.

News of the memo was reported earlier by Bloomberg.

—

Fed report shows loans are going to a wide variety of companies.

The latest update from the Federal Reserve on its emergency lending programs shows that its effort to support midsize businesses is funneling money to a varied set of companies — although it continues to see muted use relative to its vast capacity.

In the so-called Main Street program, which had helped to support slightly more than $1 billion in lending as of the Aug. 31 report, the Fed takes 95 percent of qualifying loans off bank balance sheets. The idea is to support cheap lending for companies that entered the pandemic recession in good shape. In theory, it could back up about $600 billion in loans.

Many borrowers and lenders have chosen not to use the program, either because they still have access cheaper private loans or because the terms are fairly restrictive, with limits on recipient indebtedness.

But the companies that are tapping the program appear to be a diverse group. So far, big loan recipients include Clair Global Corporation — a touring production support company — a large casino, a trucking company and several construction companies. Health care, oil and gas firms, fish companies and a holiday-themed apparel seller called Tipsy Elves were among the businesses that tapped the program for smaller amounts.

City National Bank of Florida made 59 of the 118 total Main Street program loans, accounting for $332 million of the total money lent — nearly a third of the total.

The Fed’s various emergency lending programs have also seen somewhat limited use as markets stabilized and economic activity picked up over the summer. Its corporate bond-buying program has steeply scaled back its purchases. The Fed held about $12.75 billion in corporate bonds as of early September, data out last week showed, up from $12.3 billion about a month earlier.

The detailed data released Tuesday show that the central bank is no longer increasing its holdings of exchange-traded funds, bundles of bonds that trade like stocks, as it focuses instead on individual bonds.

—

The work-from-home challenge for employees of color.

The rise of the virtual office during the coronavirus pandemic has placed special burdens on people of color.

With fewer connections and less extensive networks than white colleagues, Black and Hispanic workers can find themselves more isolated than ever in a world of Zoom calls and virtual forums. Being visible is critical for people of color in the workplace and harder to achieve in a work-from-home environment, said Joy Fitzgerald, chief diversity and inclusion officer at the drugmaker Eli Lilly.

“To succeed, 50 percent is performance, 25 percent is perception and the other 25 percent, which is a force multiplier, is visibility,” Ms. Fitzgerald said. “But if people don’t know you, they don’t see you. It creates a higher degree of complexity and challenge for underrepresented groups.”

Kimberly Bryant, the founder of the nonprofit group Black Girls Code, cited another missing piece: the spontaneous encounters with other people of color that gave her a sense of belonging as she forged a career as an engineer.

Ms. Bryant, who like Ms. Fitzgerald is African-American, said the wave in the cafeteria, the smile in the elevator and the nod in the hallway “all would lead to connections that were instrumental in terms of my success.

—

Tesla shares rediscover gravity, plunging by more than 20%.

Barely a week ago Tesla shares were flying higher than ever. The electric-car maker had just completed a five-for-one split of its shares, which closed at a split-adjusted record price. And after a fourth consecutive quarter of profitability, it seemed on the brink of addition to the S&P 500, which would create new demand for its shares from index funds.

Now things don’t look as rosy. Tesla’s shares closed at $330.21 on Tuesday, down 21 percent on the day and one-third below their recent peak.

The tumble started after the company announced in a regulatory filing on Sept. 1 that it would raise up to $5 billion in capital by selling new shares “from time to time” at market prices. That figure represented barely 1 percent of Tesla’s market capitalization, but shares fell nearly 5 percent.

Then, on Friday, Tesla was bypassed when the S&P 500 components were shuffled. And sentiment may have been influenced by a broader swoon in technology stocks that has continued into this week.

“For the last 10 years, Tesla is a stock that has been very erratic,” said Karl Brauer, an independent auto analyst. “And in the run-up in the last four months, the fundamentals simply didn’t make sense, so it’s natural that you will have big pullbacks at various times.”

Still, on a split-adjusted basis, the decline leaves Tesla shares roughly where they were in mid-August — and more than twice as valuable as in early May, when the chief executive, Elon Musk, said on Twitter that the “Tesla stock price is too high.” The company’s market capitalization is three times the combined value of Ford Motor, General Motors and Fiat Chrysler.

Oil prices dive: ‘This whole summer of bullishness is over.’

West Texas Intermediate, the American benchmark, fell around 7 percent on Tuesday to $36.94 a barrel, while Brent crude, the international standard, slipped almost 5 percent to $39.95.

“People came back from the holiday and said that this whole summer of bullishness is over,” said Roger Diwan, vice president for energy at IHS Markit, a research firm. Instead, Mr. Diwan said, market participants are responding to signs of weakening demand, growing supplies of oil, and what promises to be a nerve-jangling presidential election campaign in the United States.

Oil prices have rallied sharply from their April lows, when some futures prices fell into negative territory, and held steady during the summer. Now, when traders look ahead, prices look too high. With the summer driving season over, the outlook for demand is weak over the next few months.

At the same time, the Organization of the Petroleum Exporting Countries, which slashed oil production in May, is now adding output, joining producers in the United States, who are also gradually pumping more crude.

“Prices have diverged from fundamentals for a while,” said Amrita Sen, head of oil analysis at Energy Aspects, a market research firm.

The coronavirus pandemic, which has slammed demand, is clearly far from over, with cases rising in several countries including Britain, France and Spain. And there are signs that Chinese buyers who have stocked up on crude at what seemed low prices may be reaching their limit.

—

https://www.nytimes.com/live/2020/09/08/business/stock-market-today-coronavirus